indiana inheritance tax exemptions

Indiana has a three class inheritance tax system and the. For individuals dying after December 31 2012.

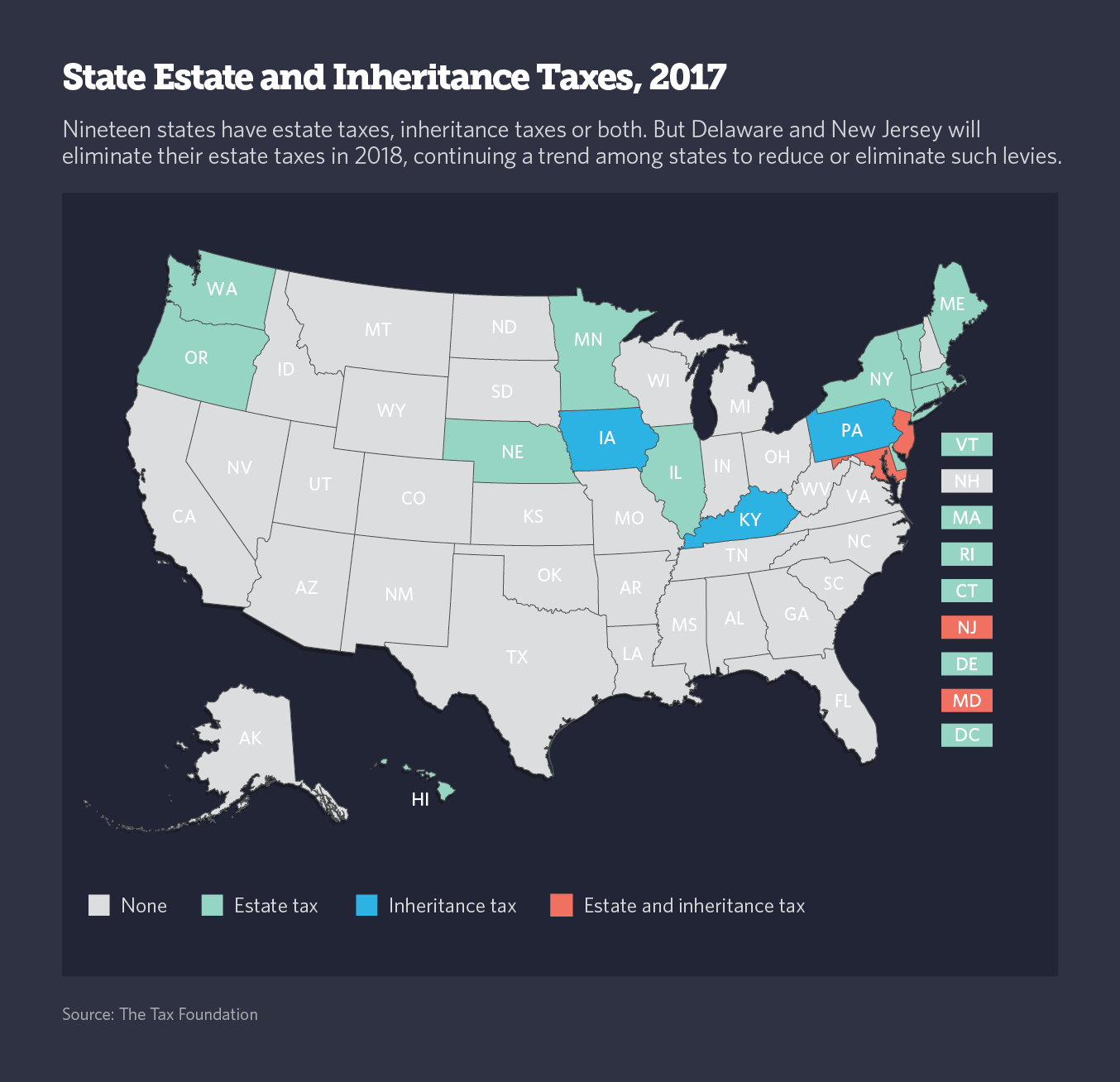

States With Inheritance Tax Or Estate Tax Bookkeepers Com

Web Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. Do not file Form IH-6 with an Indiana court having. Web by Eric N.

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our. INHERITANCE TAX EXEMPTIONS AND DEDUCTIONS IC 6-41-3 Chapter 3. This tax ended on December 31 2012.

Web How much money can you inherit without paying inheritance tax. Web In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. But just because the inheritance taxes didnt.

Last year the Indiana legislature enacted a plan to phase out Indianas Inheritance Tax by the end of year 2021. Web This means without an Indiana inheritance tax Indiana estates have to be greater than 525 million before any state or federal death taxes would be due. 205 2013 Indianas inheritance tax was repealed.

Web Inheritance Tax Forms. For deaths occurring in. Each heir or beneficiary of a decedents estate is divided into three classes.

Web Repeal of Inheritance Tax PL. Web 2012 Indiana Code TITLE 6. Web The IRS did however change the federal estate tax exemption from 2018 to 2019 from 1118 million to 114 million.

No inheritance tax returns Form IH-6 for. Keep in mind that these changes only affect those who have died. Web The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO.

Web Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. Box 71 Indianapolis IN 46206-0071. Web For more information check our list of inheritance tax forms.

DEATH TAXES CHAPTER 3. Code 6-41-3et seq. Inheritance tax was repealed for individuals dying after December 31 2012.

Indiana used to impose an inheritance tax. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax. Indiana state income tax rate is 323.

However that phase out was. Web Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7. In 2021 the credit will be 90 and the tax phases out.

Web The exemption levels increased for those designated as Class A from 100000 to 250000. Web It may be used to state that no inheritance tax is due as a result of Decedents death after application of the exemptions provided by Ind. Web Of course Indiana cannot change federal law and there does remain in existence a Federal Estate Tax.

Moved South But Still Taxed Up North

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Indiana Inheritance Laws What You Should Know Smartasset

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

The Potential For Major Estate Tax Changes During The Biden Administration What You Need To Know Inside Indiana Business

Indiana Inheritance Tax Return Ih 6 Indiana

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Form St 108e Fillable Certificate Of Gross Retail Or Use Tax Exemption

2021 Estate Income Tax Calculator Rates

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Taxed To Death No More The Indiana Lawyer

How Inheritance Tax Works Howstuffworks

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Where Not To Die In 2014 The Changing Wealth Tax Landscape

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation